It’s the time of year for saving money!

In the first installment of this-two part article, I commented that the high cost of HiFi has been a popular subject for audiophile conversation since at least the 1960s, when the Marantz and Sequerra FM tuners amazed people with both their performance and their – for the time – stratospheric pricing.

Carrying that same theme into the present by referring to the half-million dollar price tag for the current “25th Anniversary Edition” of the Goldmund Apologue speaker system, I said that one of the more common responses to products like those was for people to wonder how they could possibly cost enough to build to justify the kinds of prices their manufacturers asked for them, and I went on to show that, except to determine whether any more of a particular product will ever be built, what a product costs to build has nothing at all to do with what its real-world selling-price will be.

Carrying that same theme into the present by referring to the half-million dollar price tag for the current “25th Anniversary Edition” of the Goldmund Apologue speaker system, I said that one of the more common responses to products like those was for people to wonder how they could possibly cost enough to build to justify the kinds of prices their manufacturers asked for them, and I went on to show that, except to determine whether any more of a particular product will ever be built, what a product costs to build has nothing at all to do with what its real-world selling-price will be.

The true value of any good, I explained, is its value in exchange, and that value is determined ONLY by what a willing buyer is willing to pay for it and a willing seller is willing to take in payment.

Statements like that usually draw (if not agreement) just two kinds of responses: Either absolute rejection, based on either “intrinsic”, or “sentimental”, “moral”, “emotional” or “other” values (take your pick as to what you want to call them) or ― going the other direction entirely ― a wise nod and some platitude about “supply and demand”.

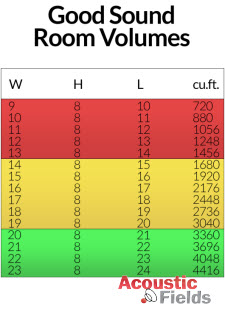

In fact, neither of those would be correct, although the “supply and demand” position does come closer. The truth is that there are actually THREE elements to price determination: Supply, Demand, and, fully as important as either of the others but almost never mentioned in ordinary conversation: The Availability of Substitutes.

In fact, neither of those would be correct, although the “supply and demand” position does come closer. The truth is that there are actually THREE elements to price determination: Supply, Demand, and, fully as important as either of the others but almost never mentioned in ordinary conversation: The Availability of Substitutes.

Here’s the proof: Let’s suppose that, just as the Hunt Brothers were able, more than thirty years ago, to “corner” the silver market, YOU have been able, not just to corner the market, but to establish an absolute MONOPOLY in steel. You now own ALL of the steel in the world, and no one can buy any of it from any other source anywhere on the planet. Pretty neat, huh? No matter HOW rich you were before, now you’re going to be able to make Bill Gates, Warren Buffet, and Carlos Slim look like pikers! After all, steel is the basic raw material for a HUGE range of products and, now that you have absolute control of it, you can charge whatever you want and people will have no choice but to pay!

Does that sound reasonable? Let’s see: (using obviously simplified numbers just to make the example easier to understand)

Let’s suppose that before your takeover, steel was selling for $3 per ton and 100,000 tons of steel were sold on the world market every day, for a total transaction value of $300,000 per day. What do you think the total daily transaction value would be if, given your total monopoly, you were to raise the price of steel from $3 to $300 per ton? Would you immediately make 100 times more money ($30,000,000 in daily sales) and truly put yourself in position to become the richest person of all time?

Probably not.

]]>One of the great axioms of economics is that “As the price of any good increases (relative to other goods) the quantity of that good that will be taken will go down.” That’s simple and it makes sense: If you go into a store to buy apples, but find that the price of apples has gone up relative to oranges, you might very well choose to buy oranges, instead. And, if you’ve only got a fixed amount of money to spend – one dollar, for example – then even if you still choose to buy apples as you had originally intended, at the new higher price, you won’t be able to buy as many. Either way, the quantity of apples sold will go down.

In the steel example, certainly just the fact that when the price of a good goes up people can’t afford to buy as much of it will result in a reduction in the amount of steel you sell. But the other thing, the one that will really be the determining factor in affecting the amount of steel sold by you, will be the fact that, when you increased the price of steel from $3 to $300 per ton, the price of SUBSTITUTES – other things that could be used instead of steel – did not also go up, and, all of a sudden, people who had previously used steel to build their products will find other things to build them out of, instead.

In the steel example, certainly just the fact that when the price of a good goes up people can’t afford to buy as much of it will result in a reduction in the amount of steel you sell. But the other thing, the one that will really be the determining factor in affecting the amount of steel sold by you, will be the fact that, when you increased the price of steel from $3 to $300 per ton, the price of SUBSTITUTES – other things that could be used instead of steel – did not also go up, and, all of a sudden, people who had previously used steel to build their products will find other things to build them out of, instead.

With the price increased 100 times, almost ANYTHING becomes an affordable substitute for steel, but even at very small price increases relative to other materials, the amount of steel used could drop dramatically. Aluminum now costs more than steel, but with the price of steel even slightly increased, aluminum might become a very attractive alternative -especially considering that it’s lighter than steel and, in these energy-conscious times, an aluminum car might use less fuel. At a little higher increase, fiberglass could be attractive, and it has advantages, too. And the higher the price increase, the more materials will become viable alternatives.

In short, even if you control the supply, entirely, if you raise the price enough, you might find yourself selling practically no steel at all, UNLESS YOU WERE TO START DROPPING YOUR PRICES. Once that happens, with steel getting cheaper and cheaper, fewer and fewer things will be viable alternatives and more and more steel will be sold.

In short, even if you control the supply, entirely, if you raise the price enough, you might find yourself selling practically no steel at all, UNLESS YOU WERE TO START DROPPING YOUR PRICES. Once that happens, with steel getting cheaper and cheaper, fewer and fewer things will be viable alternatives and more and more steel will be sold.

As with steel in this example, THE AVAILABILITY OF SUBSTITUTES LIMITS THE PRICING OF ANY GOOD BY ALLOWING PEOPLE WHO DON’T WANT TO PAY THE PRICE BEING ASKED AND WHO CAN’T NEGOTIATE IT ANY LOWER, TO SIMPLY GO ELSEWHERE AND BUY SOMETHING ELSE.

And that finally gets us to HiFi pricing, where the fact is that, unlike steel, which in most of its forms and alloys is easily substituted and available from multiple sources, HiFi products – at least at the High End – are not at all “generic” or “commodity-like”. Each has its own distinct performance, its own “image” and brand-equity, and its own limited sources of supply.

Can you really substitute tubes for solid-state? Planars for cones? Cones for horns? Jadis for McIntosh? Rowland for Krell? CDs for LPs or computer downloads? If you can, DO IT! Go shopping and find the product that’s just as good as the one you want, but cheaper, or that’s a better bargain at the same price, and BUY IT! Otherwise, either buy what you want at the price asked; negotiate a better deal; buy nothing at all, and enjoy complaining about how high the prices are; or buy something else, entirely.

That leads to something that the manufacturers need to consider, too: It’s not just other HiFi products that they are in competition with. The range of substitutes available for any good includes EVERYTHING else that a customer might spend his money on. As HiFi gets more expensive, as with anything else, the number of comparably-priced alternatives increases until, for the very most expensive products and systems, the buying decision might not just be between different HiFi products, but between a new product or system and a new house or car, or sending your kid to college. In fact, for the price of that Goldmund Apologue speaker system mentioned earlier, you could buy either a very NICE new house or THREE luxury cars: a new Bentley Continental GT ($178,000), a new Lamborghini Gallardo ($182,000), a new 2014 Maserati Quattroporte ($102,000), AND 10,000 gallons of gasoline, at 3.75 per gallon ($37,500) to run them on.

You could also just keep the money in your pocket: Buying nothing at all is one more form of substitution.